NewsFlash | Financial Readiness

Financial Readiness

Credit and Income

AnnualCreditReport.com — Credit reports may affect your mortgage rates, credit card approvals, apartment requests, or even your job application. The only official site explicitly directed by Federal law to provide free online credit reports from Equifax, Experian and TransUnion. Credit reports play an important role in your financial life and we encourage you to regularly check your credit history. Make sure that you recognize the information on your credit report including your personally identifiable information, such as names, addresses, Social Security Number, accounts and loans. Then check that the other information on your credit report is accurate and complete. If you find information that you believe does not belong to you or is not correct, contact the business that issued the account or the credit reporting company that issued the report.

OptOutPrescreen.com — The official Consumer Credit Reporting Industry website to accept and process requests from consumers to Opt-In or Opt-Out of firm offers of credit or insurance. Equifax, Experian, Innovis, and TransUnion, (collectively the "Consumer Credit Reporting Companies"), encourage you to make an informed decision about receiving firm (preapproved / prescreened) offers of credit or insurance. There are several benefits of receiving firm offers.

Request a Security Freeze — A consumer has the right, pursuant to state law, to request a security freeze be placed on certain LexisNexis Risk Solutions reports, and for LexisNexis Risk Solutions to not release those reports without the consumer lifting the security freeze. Applying a security freeze prohibits LexisNexis Risk Solutions and SageStream from releasing your LexisNexis Consumer Disclosure Report, your SageStream Consumer Report, or your credit score without your express authorization. The security freeze is designed to prevent credit, loans, and services from being approved in your name without your consent. The subject of this consumer report currently has a security freeze on file preventing the return of the information you requested. If the consumer would like their security freeze lifted, please instruct them to call LexisNexis Risk Solutions at 1-800-456-1244.

Lexis/Nexis Consumer Report — The report includes items such as real estate transaction and ownership data, lien, judgment, and bankruptcy records, professional license information, and historical addresses. You may order information on yourself by filling out a request, which must include proper identification. If you have questions or need to submit documents, you can do so via our LexisNexis Risk Solutions Reports Help page. Speak to a live LexisNexis Risk Solutions Consumer Center representative by calling 1-888-497-0011.

Lexis/Nexis Consumer Report — The report includes items such as real estate transaction and ownership data, lien, judgment, and bankruptcy records, professional license information, and historical addresses. You may order information on yourself by filling out a request, which must include proper identification. If you have questions or need to submit documents, you can do so via our LexisNexis Risk Solutions Reports Help page. Speak to a live LexisNexis Risk Solutions Consumer Center representative by calling 1-888-497-0011.

Cost of Living Allowance Watch — Periodically, VA makes cost-of-living adjustments (COLAs) to VA beneficiaries and surviving spouses. COLA is calculated by CPI-W monthly reports (July, August, September) of the current fiscal year to the average for the same months of the previous fiscal year. The Military Officers Association of America (MOAA) publishes monthly updates and inflation figures (COLA Watch) used to set the cost-of-living adjustment (COLA) for payments received by military retirees, disabled veterans, Social Security beneficiaries, and many others receiving federal compensation. COLA is calculated and reported monthly by the U.S. Bureau of Labor Statistics through the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) with final 12-Month Percent Change.

Military Veterans Life Insurance, Wills, and Legal Service

Veterans Affairs Life Insurance (VALife) — VALife provides low-cost coverage to Veterans with service-connected disabilities. As part of the VA mission to serve Servicemembers, Veterans, and their families, VA provides valuable life insurance benefits to give you the peace of mind that comes with knowing your family is protected. VALife is guaranteed acceptance whole life insurance available to all Veterans aged 80 and under, who have a VA disability rating of 0 to 100%, with no medical underwriting and no time limit to apply. Veterans who are 81 or older and apply for VA Disability Compensation for a service-connected disability before age 81 and receive a rating for that same disability after turning 81 are also eligible if they apply within two years of receiving notification of their rating. The VALife program includes key dates and features impacting the Service Disabled Veterans Insurance (S-DVI) program. VA's S-DVI program stopped taking new applications in 2022. VALife is guaranteed acceptance whole life insurance. This means that if you meet the eligibility requirements for VALife, we’ll automatically approve your application. You won’t need to prove you’re in good health. And you can keep your coverage for the rest of your life.

- If you apply for VALife by December 31, 2025, you can keep your S-DVI during the 2-year waiting period for VALife benefits. Your S-DVI (including policies with premium waivers) will end when your full VALife coverage starts. You must pay premiums for both policies during the 2-year waiting period.

- If you apply for VALife on or after January 1, 2026, your S-DVI (including policies with premium waivers) will end the day we approve your VALife application. You’ll need to pay only VALife premiums during the 2-year waiting period. But you won’t have full coverage during this time.

VA has announced that more than 3 million Veterans, Service members, and spouses who receive life insurance from VA’s programs will receive a discount on premiums starting in the spring of 2025. These decreased premiums apply to those insured under Veterans’ Group Life Insurance (VGLI), Servicemembers’ Group Life Insurance (SGLI) and Family Servicemembers’ Group Life Insurance (FSGLI) — and to those who enroll in those programs in the future.

Servicemembers’ Group Life Insurance (SGLI) and Veterans Group Life Insurance (VGLI) — With VGLI, you may be able to keep your life insurance coverage after you leave the military for as long as you continue to pay the premiums. You can get between $10,000 and $500,000 in term life insurance benefits. The amount you’ll get will be based on how much SGLI coverage you had when you left the military.

VA’s Veterans Benefits Administration Online Will Preparation Service — Financial planning and online will preparation services available at no cost to beneficiaries of service members’ group life insurance, traumatic injury protection, family service members’ group life insurance and Veterans’ group life insurance. VA also offers free legal service clinics at VA centers throughout the country. You can see a list of these legal service clinics on the VA website. You can also contact your local VA department directly or talk to an outreach specialist at a VA Medical Center. The online will preparation service enables beneficiaries to quickly and easily prepare a will without an attorney. After answering a series of straightforward questions, the beneficiary will receive a legal will, valid in all states, ready to print and sign. This service provides beneficiaries with free, professional financial advice from FinancialPoint, an independent company whose team of professionals are experts in handling a wide range of financial matters. Beneficiaries can access this service online 24/7 to request a financial plan.

Legal Help for Veterans — If you are a service member or Veteran in need of legal assistance now, there are several resources available to assist you. Many legal service providers offer free legal clinics in VA facilities.

Credit Unions and Banking

Credit Unions and Banking

NCUA Financial Well-Being of Servicemembers & Their Families — Servicemembers and military families face unique financial challenges, whether on active duty, returning to civilian life, or living as a Veteran. In recent years, servicemembers have joined the ranks of those who are considered most vulnerable to predatory lenders and identity theft. Most military families today are not saving adequately for retirement, and many do not have an emergency fund.

FDIC Money Smart — First released in 2001 and regularly updated since then, Money Smart has a long track record of success in reducing stress and improving financial readiness of Veterans. NW MIRECC started with the FDIC Money Smart program through the 'Helping Veterans #GetBanked and Manage Their Money' training program. The training program provided resources to Veterans Service Organizations, VA special Outreach Program Coordinators, and others who provide direct services to U.S. Veterans and have a direct interest in increasing Veterans’ financial capability. As a member of the Money Smart Alliance, NW MIRECC helps promote financial capability to strengthen the financial education efforts of Veterans, Servicemembers, and their families.

The Association of Military Banks of America (AMBA) — Founded in 1959, AMBA is a not-for-profit association of banks operating on military installations, banks not located on military installations but serving military customers, and military banking facilities designated by the U.S. Treasury. The association’s membership includes both community banks and large multinational financial institutions, all of which are insured by the Federal Deposit Insurance Corporation.

Veterans Benefits Banking Program — Our participating banks and credit unions offer low-to-no-cost checking accounts with no hidden fees or minimum balances. Your money is safe and accessible. Find out how easy and affordable banking can be! Participating VBBP financial institutions offer eligible Veterans, Veteran caregivers and Veteran beneficiaries federally insured and regulated financial products, services, and education that can be tailored to your needs. Neither VA nor AMBA endorses any particular banks, credit unions, products or services, or requires Veterans or other beneficiaries to use them.

Financial Wellness and Guides

Making₵ents Smart Money Strategies —  Personal Finance Knowledge Center for military life providing step-by-step information and education for navigating auto loans, saving for retirement, paying for college, buying a home and much more. From expert advice to budget calculators, our tools and resources can help you achieve your financial goals. Saving and budgeting work together to help you enjoy a better today and build a more secure tomorrow.

Personal Finance Knowledge Center for military life providing step-by-step information and education for navigating auto loans, saving for retirement, paying for college, buying a home and much more. From expert advice to budget calculators, our tools and resources can help you achieve your financial goals. Saving and budgeting work together to help you enjoy a better today and build a more secure tomorrow.

Prudential Pathways Seminars for Veterans — Prudential Financial, Inc. provide Veterans, transitioning Servicemembers and their families with access to financial wellness resources to improve their economic well-being and financial stability at no cost. Financial literacy produces better personal economic outcomes, housing stability, improved mental health and overall well-being. The resources are designed to help individuals manage their money more effectively, improve their financial resiliency, and reach their financial goals. Wellness Wednesday seminars are conducted live, offered free of charge to transitioning service members, Veterans and their families, and offer the opportunity to ask questions of a qualified financial counselor. VA partners with Prudential Financial Services. to provide these classes.

Financial Wellness: Sound Principles For Successful Money Management — Published in collaboration with nonprofit Guideposts, this instructive booklet, Financial Readiness— Sound Principles for Successful Money Management, addresses an important aspect of preparedness. Financial strains of deployments, unforeseen emergencies and “over-the-top” phone bills can burden even the most purposeful among us. Advice from trusted mentors who work to help those with financial difficulties. Providing insight into setting goals, forming budgets, understanding credit, and investing for the future are treated in clear, understandable terms. These principles help obtain a more secure financial future through more careful spending and improved saving and investing habits.

Financial Preparations for Deployment — Having a financial action plan can give you greater control and peace of mind during deployment. Here are some financial considerations before, during, and after deployment. Financial education and knowledge is important for everyone – take some time to explore the financial assessment, our tools, resources, and more.

Armed Forces Financial Guide — Now all in one place, this guide provides key information on important financial issues like qualifying for and accessing service member and military family benefits, reading your LES, everyday finances, planning for the future and much more. Created in collaboration with DCUC and AMBA, the guide was developed with the input of seasoned military leaders with education and experience in military personal finance.

Home Buying, Refinancing, and Home Loan Relief

Veterans Home Buying Guide — A tailored resource aimed at assisting Veterans through the process of purchasing a home. This comprehensive guide offers invaluable insights to help navigate the complexities of homeownership, ensuring that Veterans are well-equipped to make informed decisions. From understanding the intricacies of the home buying process to managing expectations and achieving financial goals, this guide serves as a roadmap for success. While it provides essential information, we strongly recommend consulting with a military-connected realtor and a qualified mortgage lending officer to tailor your approach to your specific needs and goals.

VA Home Loans — Lenders offer competitive mortgage interest rates on VA-backed purchase loans. VA offers these three main types of guaranteed home loan benefits:

- Purchase Loans

- Cash-Out Refinance Loans

- Interest Rate Reduction Refinance Loans (IRRRL)

VA home loan programs may be used to obtain single-family homes, new home construction, manufactured homes and lots, condominiums; or refinance an existing home loan; or install energy-saving improvements. The VA funding fee is a one-time payment that the Veteran, service member, or survivor pays on a VA-backed or VA direct home loan. Main pillars of the VA home loan benefit:

- No downpayment required

- Competitively low interest rates

- Limited closing costs

- No need for Private Mortgage Insurance (PMI)

- The VA home loan is a lifetime benefit: you can use the guaranty multiple times

VA home loan limits are the same as the Federal Housing Finance Agency (FHFA) limits. These are called conforming loan limits and loans above this amount are known as jumbo loans. Find out if you’re eligible—and how to apply for your Certificate of Eligibility (VA Form 26-1880). You’ll need to bring the Certificate of Eligibility (COE) to your lender to prove that you qualify for a VA home loan. Use VA Form 26-1880 to apply for a VA home loan COE. If you need help or have questions about your eligibility, call us at 1-877-827-3702.

VA’s Native American Direct Loan (NADL) — VA provides loans for purchase, construction, or home improvement on federal Trust Land. Get answers to your questions about the VA-guaranteed home loan program by contacting a VA home loan representative at 1-877-827-3702.

VA’s Native American Direct Loan (NADL) — VA provides loans for purchase, construction, or home improvement on federal Trust Land. Get answers to your questions about the VA-guaranteed home loan program by contacting a VA home loan representative at 1-877-827-3702.

VA Interest Rate Reduction Refinance Loan (IRRRL) — If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments an IRRRL may be right for you. The VA IRRRL can be used to refinance an existing VA loan to lower the interest rate. Often called a “streamline” refinance; refinancing lets you replace your current loan with a new one under different terms. Find out if you're eligible for a VA-backed cash-out refinance loan. A VA-backed cash-out refinance loan lets you replace your current loan with a new one under different terms. If you want to take cash out of your home equity or refinance a non-VA loan into a VA-backed loan, a VA-backed cash-out refinance loan may be right for you.

- Find a Lender — You’ll go through a private bank, mortgage company, or credit union—not directly through us—to get an IRRRL. Terms and fees may vary, so contact several lenders to check out your options.

- Give your lender any needed information. — If you have the Certificate of Eligibility (COE) you used to get your original VA-backed home loan, take it to your lender to show the prior use of your entitlement. If you don’t have your original COE, ask your lender to get your COE electronically through the VA Home Loan program portal.

- Follow your lender’s process for closing on the IRRRL loan, and pay your closing costs. — You may need to pay the VA funding fee. This one-time fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance. Your lender will also charge interest on the loan in addition to closing fees. With an IRRRL, you can include these costs in the new loan so you don’t have to pay up front. Or, you may be able to make the new loan at an interest rate high enough so your lender can pay the costs.

VA Home Loan Temporary Financial Hardship — If you’re behind and missed mortgage payments, on your mortgage payments, contact a VA loan technician at 1-877-827-3702 or the servicer of your mortgage to get help. If you fall behind on your mortgage payments, your mortgage servicer (the company that handles collecting the money for your lender) can take your house to cover the money owed. This process is called foreclosure. VA works with the borrower to avoid foreclosure, including providing financial counseling and, in some cases, direct intervention with a mortgage loan servicer on the borrower’s behalf. Can I get VA counseling to help avoid foreclosure?

VA Home Loan Temporary Financial Hardship — If you’re behind and missed mortgage payments, on your mortgage payments, contact a VA loan technician at 1-877-827-3702 or the servicer of your mortgage to get help. If you fall behind on your mortgage payments, your mortgage servicer (the company that handles collecting the money for your lender) can take your house to cover the money owed. This process is called foreclosure. VA works with the borrower to avoid foreclosure, including providing financial counseling and, in some cases, direct intervention with a mortgage loan servicer on the borrower’s behalf. Can I get VA counseling to help avoid foreclosure?

- If you’re a Veteran or the surviving spouse of a Veteran, we’ll provide counseling—even if your loan isn’t a VA-guaranteed loan.

- If you have a VA-guaranteed loan, you can contact us anytime to discuss your loan.

- If you have a VA-guaranteed loan and it’s 61 days past due, we’ll automatically assign a VA loan technician to review your loan.

If you're behind on your mortgage payments, contact us or the servicer of your mortgage to get help. And be careful of scams. Work only with trusted organizations. If your loan ends in foreclosure, short sale, or deed in lieu of foreclosure, you'll need to pay back the amount we lost on your loan to restore your future benefit. We call this process “restoration of entitlement.” To find out the amount you need to pay to restore your entitlement, contact a VA loan technician at 1-877-827-3702.

VA Vendee Loan Program — VA directs a nationwide home loan guaranty program for eligible Veterans. Loans financed by VA are known as "Vendee loans". When a loan is foreclosed, VA usually acquires and resells the single-family residences and condominiums that were the security for the loans. The VA Vendee Loan Program offers qualified borrowers the option of purchasing VA Real Estate Owned (REO) properties with little to no money down.

- For Veterans, non-Veterans, owner-occupants, and investors

- Financing with little to no money down

- Origination and funding fees may be rolled into the loan for qualified borrowers

- 15 or 30-year loan term options

- Competitive interest rate

- Seller may contribute toward closing costs

- No appraisal requirement, No pre-payment penalties, No mortgage insurance requirements

Home Improvement and State Department of Veterans Affairs

Disability Grants for Veterans — VA provides housing, automobile, and clothing grants for Veterans and service members with certain service-connected disabilities. VA provides a Specially Adapted Housing (SAH) grant to assist with the cost of building, buying, adapting existing homes or paying to reduce indebtedness on a currently owned home that is being adapted, up to a maximum benefit amount. VA's SAH grant provides up to $117,014. VA may approve a Special Home Adaptation (SHA) grant to assist with the cost of adapting or purchasing a home to live more independently. VA's SHA grant provides up to $23,444.

Disability Grants for Veterans — VA provides housing, automobile, and clothing grants for Veterans and service members with certain service-connected disabilities. VA provides a Specially Adapted Housing (SAH) grant to assist with the cost of building, buying, adapting existing homes or paying to reduce indebtedness on a currently owned home that is being adapted, up to a maximum benefit amount. VA's SAH grant provides up to $117,014. VA may approve a Special Home Adaptation (SHA) grant to assist with the cost of adapting or purchasing a home to live more independently. VA's SHA grant provides up to $23,444.

Home Improvements and Structural Alterations (HISA): This benefit provides medically necessary improvements and structural alterations to Veterans/Servicemembers’ primary residence. VA provides up to $6,800 in lifetime benefits for service-connected Veterans. Up to $2,000 in lifetime benefits for nonservice-connected Veterans to make home improvements and/or structural changes necessary for the continuation of treatment or for disability access to the Veterans home and essential lavatory and sanitary facilities. All HISA projects must be medically justified for the service connected disability and/or non-service connected disability. Contact VA's Prosthetic and Sensory Aids Service to determine your available lifetime HISA benefits.

Helping a Hero — Helping a Hero provides specially adapted homes for qualifying service members through partnerships made with the builders, developers, communities, and the Veteran. Ordinarily, homes are built in master-planned communities where the developer donates the lot and the builder builds at cost.

Gary Sinise Foundation Restoring Independence Supporting Empowerment (R.I.S.E.) — The Gary Sinise Foundation serves our nation by honoring our defenders, Veterans, first responders, their families, and those in need. Core programs include R.I.S.E. which provides homes and/or home modifications for severely wounded Veterans; Relieve & Resiliency which supports families facing hardships before, during or after serving; First Responders Outreach which supports firefighters, police and EMTs who sacrifice daily to ensure our safety, with funding, equipment, PPE and training.

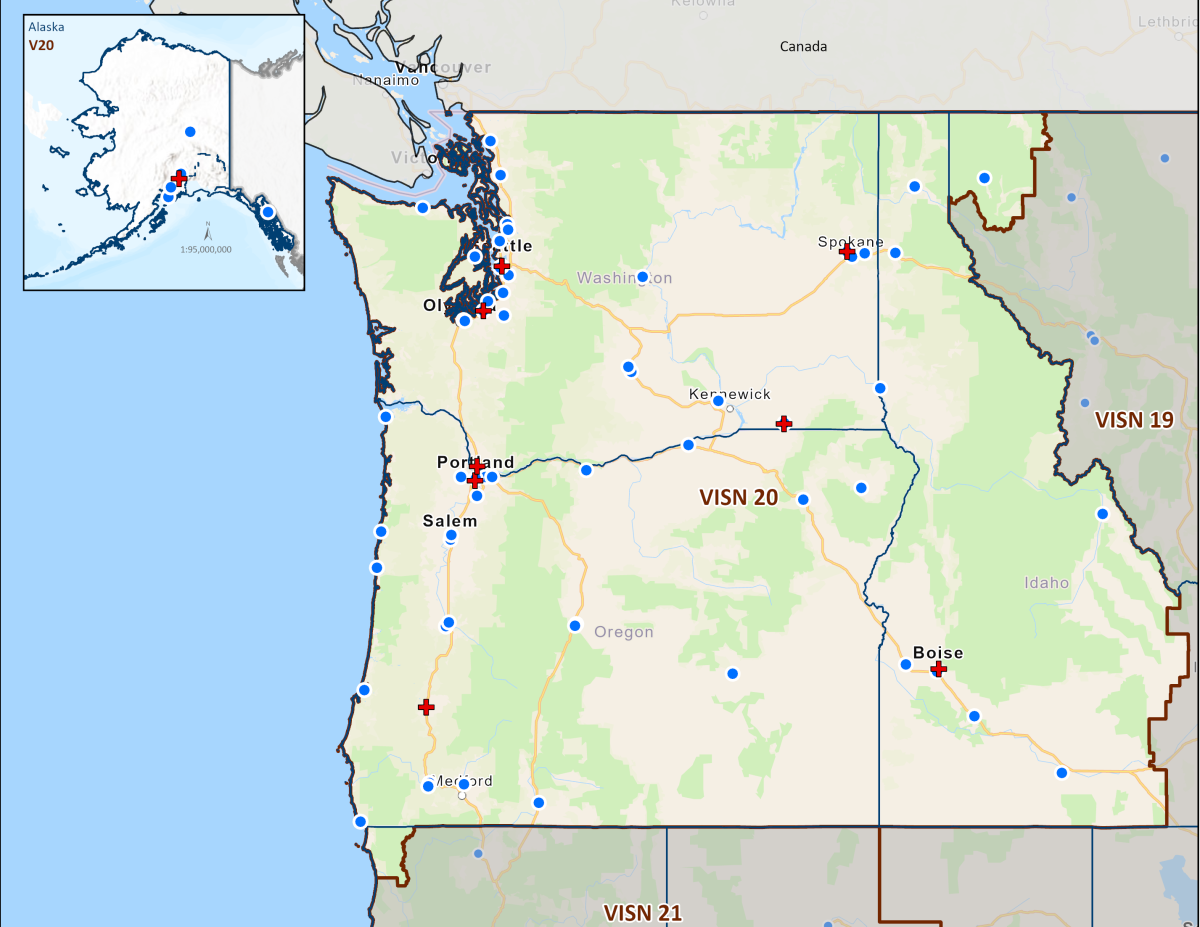

State Department of Veterans Affairs located in VA's Veterans Integrated Service Network (VISN) 20 provide Veterans assistance for home ownership and financial readiness.

Alaska

Idaho

- Veteran grants for food, fuel, shelter, and other necessities of daily living

- Property Tax Benefit for Disabled Veterans

Oregon

- Oregon Veterans Home Loan

- Veterans Emergency Financial Assistance Program

- Disabled Veteran or Surviving Spouse Property Tax Exemption

Washington

- Veterans Downpayment Assistance Loan Program

- Veterans Innovation Program (VIP)

- Property Tax Relief for Veterans and Widows(ers) of Veterans

The National Association of State Directors of Veterans Affairs (NASDVA) — NASDVA is an organization with a history dating back to 1946. Find direct links to each state and territory's website and a colleciton of federal resources. NASDVA’s purpose is to foster the effective representation of persons claiming entitlements on account of the honorable military service of any person as defined in 38 U.S.C. 101; provide a medium for the exchange of ideas and information; facilitate reciprocal state services; secure uniformity, equality, efficiency, and effectiveness in providing services to veterans and their family members in all states and territories.

Semper Fi & America’s Fund — The Fund can help critically wounded, ill, and injured Service members, Veterans, and military families with an array of modifications to improve accessibility and mobility throughout their home. Many of our Service members, Veterans, and military families assisted by Semper Fi & America’s Fund require essential, but expensive, home modifications to improve accessibility. Whether it’s wheelchair ramps, widening doorways, or modifying showers and bathrooms, The Fund ensures that homes are tailored to comfortably accommodate their needs. We ensure that those we serve have a safe place to call ‘home’ by granting assistance for urgently needed rent, mortgage, and utility payments, as well as non-adaptive home repairs.

Grants and Allowances

V A's Automobile Allowance and Adaptive Equipment grant changes a vehicle so it has features like power steering, brakes, seats, windows, or lift equipment to help you get into and out of the vehicle. The Automobile Adaptive Equipment (AAE) program prescribes and pays for adaptive equipment to allow an eligible person to safely operate and enter/exit from their personal vehicle (38 USC 3901-3903; 38 CFR 17.155-159). All AAE must be prescribed by a VHA physician and/or Certified Drivers Rehabilitation Specialist (CDRS). AAE is individually prescribed based on the Veterans need to safely operate and/or enter and exit their personal vehicles. If you have a service-connected disability that prevents you from driving, VA's automobile allowance special benefit grant provides up to $25,603.02 toward a specially equipped vehicle for you.

A's Automobile Allowance and Adaptive Equipment grant changes a vehicle so it has features like power steering, brakes, seats, windows, or lift equipment to help you get into and out of the vehicle. The Automobile Adaptive Equipment (AAE) program prescribes and pays for adaptive equipment to allow an eligible person to safely operate and enter/exit from their personal vehicle (38 USC 3901-3903; 38 CFR 17.155-159). All AAE must be prescribed by a VHA physician and/or Certified Drivers Rehabilitation Specialist (CDRS). AAE is individually prescribed based on the Veterans need to safely operate and/or enter and exit their personal vehicles. If you have a service-connected disability that prevents you from driving, VA's automobile allowance special benefit grant provides up to $25,603.02 toward a specially equipped vehicle for you.

VA provides Veterans with a clothing allowance to replace clothes damaged by a medicine or prosthetic or orthopedic device related to your service-connected disability. Public Law (PL) 117-328, section 201 authorizes VA to pay a recurring annual clothing allowance to eligible Veterans (38 USC 1162). Also, PL 117-328 section 201, requires VA to make annual recurring payments without the need to submit an annual application for eligible Veterans who do not have any changes to their prescribed devices and/or skin medications.

Veterans eligible for clothing allowance benefit:

- Veterans who are rated for a service-connected disability for which they use a prosthetic or orthopedic appliance(s) may be entitled.

- Veterans whose service-connected skin condition requires a prescribed skin medication that irreparably damages the Veteran's outer garments may be entitled.

This allowance is also available to any Veteran whose service-connected skin condition requires prescribed skin medication that irreparably damages their outer garments. If a skin medicine, prosthetic, or orthopedic device related to your service-connected disability damages your clothes, VA's clothing allowance special benefit grant provides $999.51 to replace the damaged clothes. This may be a one-time payment or VA may pay this amount once a year.

Financial Wellness and Retirement

Guide to the Military's Blended Retirement System — This booklet is the essential guide to DoDs retirement initiative. The guide clearly describes the key features and benefits of the this system, including the tax-deferred TSP account, matching contributions from the DoD, and investment choices and strategies for building a retirement portfolio. DoD matches 100% of the first 3% of basic pay that a member contributes to a TSP account, plus 50% of additional contributions, up to 5% of basic pay. That’s the same match available to civilian employees in the Federal Employee Retirement System (FERS).

Guide to the Military's Blended Retirement System — This booklet is the essential guide to DoDs retirement initiative. The guide clearly describes the key features and benefits of the this system, including the tax-deferred TSP account, matching contributions from the DoD, and investment choices and strategies for building a retirement portfolio. DoD matches 100% of the first 3% of basic pay that a member contributes to a TSP account, plus 50% of additional contributions, up to 5% of basic pay. That’s the same match available to civilian employees in the Federal Employee Retirement System (FERS).

Blended Retirement System — The Blended Retirement System combines elements of the legacy retirement system with benefits similar to those offered in many civilian 401(k) plans. BRS is a modernized retirement plan for the Uniformed Services that is available to eligible service members. Features of the BRS includes a defined benefit (monthly retired pay for life) after at least 20 years of service, a defined benefit (consisting of government automatic and matching contributions) to a member’s Thrift Savings Plan (TSP) account, a bonus called continuation pay and a new lump sum option at retirement. Learn how to maximize your retirement choice through the information found through the Department of Defense Military Compensation website.

Military Service Buy Back — If you’re currently a civilian employee who was previously enlisted in the military and were honorably discharged, you may be eligible to buy back your military service time to be added to your years of civil service with the government. Military Buy Back, also known as a Military Service Deposit, is a benefit of Federal Civil Service that gives you the ability to receive retirement benefits based on your military service. As a general rule, your military service time is creditable for Federal Civil Service purposes if it was active service terminated under honorable conditions. To buy back military time, veterans must deposit money that covers their military service. The deposit is processed through Defense Finance and Accounting Service (DFAS) or the veteran's agency's Personnel or Human Resources Office.

Thrift Savings Plan (TSP) — TSP is a retirement savings and investment plan for federal employees and members of the Uniformed Services. It offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans. The TSP is a defined contribution plan, meaning that the retirement income you receive from your TSP account will depend on how much you (and your Service, if you are receiving Service contributions) contribute to your account during your working years and the earnings that accumulate over that time. The TSP is a retirement savings and investment plan for federal employees and members of the Uniformed Services. It offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans. The TSP is a defined contribution plan, meaning that the retirement income you receive from your TSP account will depend on how much you (and your Service, if you are receiving Service contributions) contribute to your account during your working years and the earnings that accumulate over that time.

Veterans Service Organizations (VSO's) and Military Support

Disabled American Veterans (DAV) National Service Foundation — The DAV National Service Foundation develops financial resources for the assistance, aid, maintenance, care, support and rehabilitation of sick and injured veterans and their dependents, either directly or by contributions to the service programs of the DAV national organization or its departments and chapters. To carry out this responsibility, the DAV National Service Foundation supports DAV’s daily work to meet the most significant and immediate needs of veterans, which includes providing free, professional assistance with disability claims and benefits; no-cost transportation to and from medical appointments; and other vital services imperative to the quality of life of veterans and their families. Within the DAV National Service Foundation, The Columbia Trust exists as a “restricted fund” to support DAV service programs. The use of the Columbia Trust is limited to the purpose for which they were collected — service to veterans and their families at the department and local levels. The Trust is led by ill and injured veterans who focus on carefully managing resources to fund new and unique programs for fellow ill and injured veterans and their families nationwide. DAV Department and Chapter leaders are encouraged to identify unmet needs and develop unique and creative projects to serve sick and injured veterans in their communities. Service is the cornerstone of DAV’s longstanding mission to empower veterans to lead high quality lives with respect and dignity. For decades, sick and injured veterans have counted on DAV National Service Officers (NSOs) to receive earned benefits. NSOs also provide emergency relief, counseling and claims assistance. All of these outstanding services are provided to veterans free of charge.

Disabled American Veterans (DAV) National Service Foundation — The DAV National Service Foundation develops financial resources for the assistance, aid, maintenance, care, support and rehabilitation of sick and injured veterans and their dependents, either directly or by contributions to the service programs of the DAV national organization or its departments and chapters. To carry out this responsibility, the DAV National Service Foundation supports DAV’s daily work to meet the most significant and immediate needs of veterans, which includes providing free, professional assistance with disability claims and benefits; no-cost transportation to and from medical appointments; and other vital services imperative to the quality of life of veterans and their families. Within the DAV National Service Foundation, The Columbia Trust exists as a “restricted fund” to support DAV service programs. The use of the Columbia Trust is limited to the purpose for which they were collected — service to veterans and their families at the department and local levels. The Trust is led by ill and injured veterans who focus on carefully managing resources to fund new and unique programs for fellow ill and injured veterans and their families nationwide. DAV Department and Chapter leaders are encouraged to identify unmet needs and develop unique and creative projects to serve sick and injured veterans in their communities. Service is the cornerstone of DAV’s longstanding mission to empower veterans to lead high quality lives with respect and dignity. For decades, sick and injured veterans have counted on DAV National Service Officers (NSOs) to receive earned benefits. NSOs also provide emergency relief, counseling and claims assistance. All of these outstanding services are provided to veterans free of charge.

American Legion National Emergency Fund (NEF) — Since the early 1920s, American Legion has been actively involved in meeting the needs of both the community and individual Legion Family members in the wake of disasters such as hurricanes, tornadoes, earthquakes and wildfires. American Legion's NEF provides up to $3,000 for qualified American Legion members and up to $10,000 for American Legion posts. Applicant must have been displaced from their primary residence due damage sustained during a declared natural disaster. The American Legion NEF is not meant to replace or repair items, only to meet most immediate needs (i.e., temporary housing, food, water, clothing, diapers, etc.) during the period immediately following the disaster.

American Red Cross Emergency Services — The Department of Defense (DoD) and the American Red Cross have partnered since 1881. The American Red Cross delivers verified messages to deployed service members during emergencies at home. The American Red Cross Hero Care Center is available 7 days a week, 24 hours a day, 365 days a year. The purpose of the American Red Cross is to meet the immediate disaster-caused needs of individuals, families, and communities. Explore how American Red Cross responds to disasters big and small, across the country.

American Red Cross Emergency Services — The Department of Defense (DoD) and the American Red Cross have partnered since 1881. The American Red Cross delivers verified messages to deployed service members during emergencies at home. The American Red Cross Hero Care Center is available 7 days a week, 24 hours a day, 365 days a year. The purpose of the American Red Cross is to meet the immediate disaster-caused needs of individuals, families, and communities. Explore how American Red Cross responds to disasters big and small, across the country.

Veterans of Foreign Wars (VFW) Unmet Needs Financial Grant — The VFW mission is to support programs that increase awareness of the sacrifices America's veterans make through their military service. The VFW Unmet Needs program helps America's active-duty service members and their families who run into unexpected financial difficulties as as a result of deployment or other military-related activity or injury. VFW Unmet Needs Financial Grants provides financial assistance up to $2,500 to assist daily necessities in the form of a grant – not a loan – so no repayment is required.

Army Emergency Relief — Charged with relieving undue financial stress on the force, AER serves the enduring priorities of the Secretary and Chief of Staff of the U.S. Army. Company commanders or first sergeants can approve immediate financial assistance. AER provides immediate financial assistance up to $2,000 through the Quick Assist Program.

Navy-Marine Corps Relief Society — Navy-Marine Corps Relief Society provides financial assistance and education, as well as other programs and services, to active duty and retired Sailors, Marines and their families in financial need. Quick Assist Loans (QALs) provide Active duty Sailors and Marines up to $1,000. If your financial need is greater than $1,000 or you are not eligible for a QAL, additional assistance is available. Navy-Marine Corps Relief Society will work with Sailors and Marines to identify immediate needs, determine assistance, develop a budget plan for a long-term solution and identify resources.

Navy Safe Harbor Foundation (NSHF) — Since 2009, Navy Safe Harbor Foundation has been the Navy Wounded Warrior (NWW) Program’s first call when a Navy or Coast Guard Sailor is in need. Financial Support of the family system, childcare, family camps, and respite care. NSHF aims to ensure that every seriously wounded, ill and injured Navy and Coast Guard Sailor is given every opportunity for a full recovery by providing non-medical care and support to them and their families. NSHF Services & Accommodations includees Financial Support, Travel Expenses, Wounded Warriors Weekend, Housing, Rental Support, Family Support, Adaptive Athletics, Housing Modifications, Vehicle Modifications, Specialized Equipment, Public Awareness, and PTSD Programs & Education.

Navy Safe Harbor Foundation (NSHF) — Since 2009, Navy Safe Harbor Foundation has been the Navy Wounded Warrior (NWW) Program’s first call when a Navy or Coast Guard Sailor is in need. Financial Support of the family system, childcare, family camps, and respite care. NSHF aims to ensure that every seriously wounded, ill and injured Navy and Coast Guard Sailor is given every opportunity for a full recovery by providing non-medical care and support to them and their families. NSHF Services & Accommodations includees Financial Support, Travel Expenses, Wounded Warriors Weekend, Housing, Rental Support, Family Support, Adaptive Athletics, Housing Modifications, Vehicle Modifications, Specialized Equipment, Public Awareness, and PTSD Programs & Education.

Coast Guard Mutual Assistance — Supporting and offering aid to the entire Coast Guard family; Active-duty and retired military personnel, civilian employees, commissioned officers of the Public Health Service serving with the Coast Guard, Reservists, Auxiliarists, and their families.

Air Force Aid Society — The Air Force Aid Society (AFAS) works to support and enhance the U.S. Air Force and U.S. Space Force missions by providing emergency financial assistance, educational support, and community programs to Air Force and Space Force families.

Sign up for email updates or access your subscriber preferences: https://public.govdelivery.com/accounts/USVHAVISN20/subscriber/new.

Use of these Materials and Finding VA Health Care

Please note that the information provided in these materials is for educational purposes only. It does not replace the role of a financial advisor for advice on savings and investments. Investing in your future means saving for retirement, college or a rainy day fund. If you're working with an investment professional, or someone is trying to sell you an investment, check them out before handing over your hard-earned money. As a Veteran, you have access to information about legal services and financial guidance from reliable sources including, but not limited to; VA, Vet Centers, and accredited Veterans Service Organizations. If you are looking for professional medical care, find your local VA healthcare center by using the VA Facilities Locator & Directory. This page may contain links that will take you outside of the Department of Veterans Affairs website. VA does not endorse and is not responsible for the content of the linked websites.

VA Web Disclaimers

Disclaimer of Endorsement: Reference herein to any specific commercial products, process, or service by trade name, trademark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States Government. The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States Government, and shall not be used for advertising or product endorsement purposes.

Disclaimer of Hyperlinks: The appearance of external hyperlinks does not constitute endorsement by the Department of Veterans Affairs of the linked websites, or the information, products or services contained therein. For other than authorized VA activities, the Department does not exercise any editorial control over the information you may find at these locations. All links are provided with the intent of meeting the mission of the Department and the VA website. Please let us know about existing external links which you believe are inappropriate and about specific additional external links which you believe ought to be included.

Disclaimer of Liability: With respect to documents available from this server, neither the United States Government nor any of its employees, makes any warranty, express or implied, including the warranties of merchantability and fitness for a particular purpose, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights.

Reference from this web page or from any of the information services sponsored by the VA to any non-governmental entity, product, service or information does not constitute an endorsement or recommendation by the VA or any of its employees. We are not responsible for the content of any "off-site" web pages referenced from this server.

Disclaimer: The sharing of any non-VA information does not constitute an endorsement of products or services on the part of the VA.

![]()

Today's VHA - the largest of the three administrations that comprise the VA - continues to meet Veterans' changing medical, surgical, and quality-of-life needs. VHA is the largest integrated health care system in the United States, providing care at 1,321 health care facilities, including 172 VA Medical Centers and 1,138 outpatient sites of care of varying complexity (VHA outpatient clinics) to over 9 million Veterans enrolled in the VA health care program. There are 18 Veterans Integrated Service Networks (VISNs) in VHA operating as regional systems of care to better meet local health care needs and provides greater access to care. In the Pacific Northwest, VISN 20 serves Veterans in Alaska, Oregon, Washington, most of Idaho, and one county each in California and Montana. Spanning 23% of the US land mass, VISN 20 is the largest geographic region of VA. Operating across three time zones over 817,417 square miles, VISN 20 is home to 273 federally recognized American Indian and Alaskan Native tribes. According to DoD, American Indians and Alaska Natives have one of the highest representations in the United States Armed Forces. VA consults with American Indian and Alaska Native tribal governments to develop partnerships that enhance access to services and benefits by Veterans and their families. VA is committed to ensuring that Native American Veterans and their families are able to utilize all benefits and services they are entitled to receive. As of the end of FY2024, 39% of VISN 20 enrollees resided in rural or highly rural areas. Veterans may be eligible to receive care from a community provider when VA cannot provide the care needed. Veterans Community Care Program (VCCP) provides health care for Veterans from providers in the local community. VCCP includes General Community Care, Urgent Care, Emergency Care, Foreign Medical Care, Home Health and Hospice Care, Indian and Tribal Health Services, In Vitro Fertilization, State Veterans Home, and Flu Shots.

Today's VHA - the largest of the three administrations that comprise the VA - continues to meet Veterans' changing medical, surgical, and quality-of-life needs. VHA is the largest integrated health care system in the United States, providing care at 1,321 health care facilities, including 172 VA Medical Centers and 1,138 outpatient sites of care of varying complexity (VHA outpatient clinics) to over 9 million Veterans enrolled in the VA health care program. There are 18 Veterans Integrated Service Networks (VISNs) in VHA operating as regional systems of care to better meet local health care needs and provides greater access to care. In the Pacific Northwest, VISN 20 serves Veterans in Alaska, Oregon, Washington, most of Idaho, and one county each in California and Montana. Spanning 23% of the US land mass, VISN 20 is the largest geographic region of VA. Operating across three time zones over 817,417 square miles, VISN 20 is home to 273 federally recognized American Indian and Alaskan Native tribes. According to DoD, American Indians and Alaska Natives have one of the highest representations in the United States Armed Forces. VA consults with American Indian and Alaska Native tribal governments to develop partnerships that enhance access to services and benefits by Veterans and their families. VA is committed to ensuring that Native American Veterans and their families are able to utilize all benefits and services they are entitled to receive. As of the end of FY2024, 39% of VISN 20 enrollees resided in rural or highly rural areas. Veterans may be eligible to receive care from a community provider when VA cannot provide the care needed. Veterans Community Care Program (VCCP) provides health care for Veterans from providers in the local community. VCCP includes General Community Care, Urgent Care, Emergency Care, Foreign Medical Care, Home Health and Hospice Care, Indian and Tribal Health Services, In Vitro Fertilization, State Veterans Home, and Flu Shots.

VA Puget Sound Health Care System (VAPSHCS) serves Veterans from a five-state area in the Pacific Northwest with two main divisions: American Lake VA Medical Center and Seattle VA Medical Center. Veterans Medical Centers are also located in Spokane, Vancouver, and Walla Walla. VA Outpatient Clinics and Vet Centers are located in Bellingham, Bellevue, Bremerton, Edmunds, Everett, Federal Way, Lacey, Mount Vernon, Olympia, Port Angeles, Puyallup, Richland, Renton, Silverdale, Seattle, Spokane, Union Gap, Vancouver, Walla Walla, Wenatchee, and Yakima.

VA Portland Health Care System (VAPORHCS) serves Veterans in Oregon and Southwest Washington with two main divisions: Portland VA Medical Center and Vancouver VA Medical Center. Veterans Medical Centers are also located in Roseburg, White City, and Vancouver, Washington. VA Outpatient Clinics and Vet Centers are located in Astoria, Bend, Boardman, Brookings, Eugene, Fairview, Grants Pass, Hines, Hillsboro, Klamath Falls, LaGrande, Lincoln City, Newport, Portland, Salem, The Dalles, and West Linn.

VA Regional Offices

The Veterans Benefits Administration (VBA) helps service members transition out of military service, and assists with Veterans with education, home loans, life insurance and much more. Service members, Veterans, their families, and Survivors are invited to request information on VA Benefits including disability compensation, pension, fiduciary, education, Veteran Readiness and Employment (VR&E), Home Loans, and Insurance. In addition to information on VA Benefits Veterans may initiate an intent to file and request assistance with filing compensation and pension claims. Visit regional office websites to learn about the services the regional office provides, directions to the facility, hours of operation, and the leadership team that serves the regional office.

The Veterans Benefits Administration (VBA) helps service members transition out of military service, and assists with Veterans with education, home loans, life insurance and much more. Service members, Veterans, their families, and Survivors are invited to request information on VA Benefits including disability compensation, pension, fiduciary, education, Veteran Readiness and Employment (VR&E), Home Loans, and Insurance. In addition to information on VA Benefits Veterans may initiate an intent to file and request assistance with filing compensation and pension claims. Visit regional office websites to learn about the services the regional office provides, directions to the facility, hours of operation, and the leadership team that serves the regional office.

Find out if you can get VA health care as a Veteran

The following four categories of Veterans are not required to enroll but are urged to do so to permit better planning of health resources:

- Veterans with a service-connected (SC) disability rated at 50% or more.

- Veterans seeking care for a disability the military determined was incurred or aggravated in the line of duty, but which VA has not yet rated, within 12 months of discharge.

- Veterans seeking care for a SC disability only or under a special treatment authority.

- Veterans seeking registry examinations (ionizing radiation, Agent Orange, Gulf War/Operation Enduring Freedom/Operation Iraqi Freedom/Operation New Dawn (OEF/OIF/OND) depleted uranium, airborne hazards, and Open Burn Pit Registry).

Find out how to apply for VA health care benefits as a Veteran or service member. For other mental health services, contact a VA medical center for information on eligibility and treatment options.

Vet Centers in VISN 20

Vet Centers in VISN 20 are community-based counseling centers that provide a wide range of social and psychological services, including professional readjustment counseling to eligible Veterans, active-duty Army, Navy, Marine Corp, Air Force, Space Force, and Coast Guard service members, including National Guard and Reserve components, and their families. 1-877-927-8387 is an around the clock confidential call center where combat Veterans and their families can call to talk about their military experience or any other issue they are facing in their readjustment to civilian life. The staff is comprised of combat Veterans from several eras as well as families members of combat Veterans. This benefit is prepaid through the Veteran’s military service.

Vet Centers in VISN 20 are community-based counseling centers that provide a wide range of social and psychological services, including professional readjustment counseling to eligible Veterans, active-duty Army, Navy, Marine Corp, Air Force, Space Force, and Coast Guard service members, including National Guard and Reserve components, and their families. 1-877-927-8387 is an around the clock confidential call center where combat Veterans and their families can call to talk about their military experience or any other issue they are facing in their readjustment to civilian life. The staff is comprised of combat Veterans from several eras as well as families members of combat Veterans. This benefit is prepaid through the Veteran’s military service.

Alaska

| Anchorage Vet Center (Anchorage, AK) | Fairbanks Vet Center (Fairbanks, AK) |

| Kenai Vet Center Outstation (Soldotna, AK) | Wasilla Vet Center (Wasilla, AK) |

Idaho

| Boise Vet Center (Boise, ID) |

Oregon

| Central Oregon Vet Center (Bend, OR) | Eugene Vet Center (Eugene, OR) |

| Grants Pass Vet Center (Grants Pass, OR) | Portland, OR Vet Center (Portland, OR) |

| Salem Vet Center (Salem, OR) |

Washington

Plan your trip to VA

In 1946, Veterans Canteen Service (VCS) was established by law to provide comfort and well-being to America’s Veterans. With our many retail stores, cafés and coffee shops across the country, we serve those who have served our country. We are a self-sustaining entity providing merchandise and services to Veterans enrolled in VA’s healthcare system, their families, caregivers, VA employees, volunteers and visitors. We are honored to give back to the VA community through many programs established for the health and well-being of our nation’s heroes. Revenues generated from VCS are used to support a variety of programs, such as VA’s Rehabilitation Games, Fisher Houses, Poly-Trauma Centers for OIF/OEF/OND Veterans, disaster relief efforts, Substance Abuse Cessation, VA’s Homelessness initiatives, Women Veterans, Veteran Suicide Prevention and other activities.

In 1946, Veterans Canteen Service (VCS) was established by law to provide comfort and well-being to America’s Veterans. With our many retail stores, cafés and coffee shops across the country, we serve those who have served our country. We are a self-sustaining entity providing merchandise and services to Veterans enrolled in VA’s healthcare system, their families, caregivers, VA employees, volunteers and visitors. We are honored to give back to the VA community through many programs established for the health and well-being of our nation’s heroes. Revenues generated from VCS are used to support a variety of programs, such as VA’s Rehabilitation Games, Fisher Houses, Poly-Trauma Centers for OIF/OEF/OND Veterans, disaster relief efforts, Substance Abuse Cessation, VA’s Homelessness initiatives, Women Veterans, Veteran Suicide Prevention and other activities.

VCS operates over 200 Patriot Stores in Veterans Administration (VA) Medical Centers nationwide. Many of our stores have been recently updated and expanded to provide our customers with a modern, clean and comfortable shopping experience. Our stores welcome our customers with wider aisles, wood-like floors, enhanced lighting and directional signage. PatriotStores have expanded hours of operation to provide service for customers on weekends at most locations.

The Patriot Cafe is the best place in the VA Medical Center to enjoy delicious, freshly prepared breakfast or lunch served hot or cold each weekday. Providing Veterans, their families, VA employees, volunteers and visitors a place to relax and enjoy a meal or take-out for their convenience. With a wide variety of food from traditional comfort food, specialized menu selections and a large assortment of healthy choices; there is something for everyone's taste buds.

Hospital Service Directory

To find out whether there is a van near you use the Disabled American Veterans (DAV) Hospital Service Coordinator Directory to contact your nearest HSC for information or assistance. Please remember that the DAV Transportation Network is staffed by volunteers; therefore, it is unable to cover every community.